pay my income tax online

ESTIMATED TAX PAID 25. Only a small fee is charged.

How Can I Pay My Income Tax Online Taxaj

How income gets taxed Income is taxed differently depending on where it comes from.

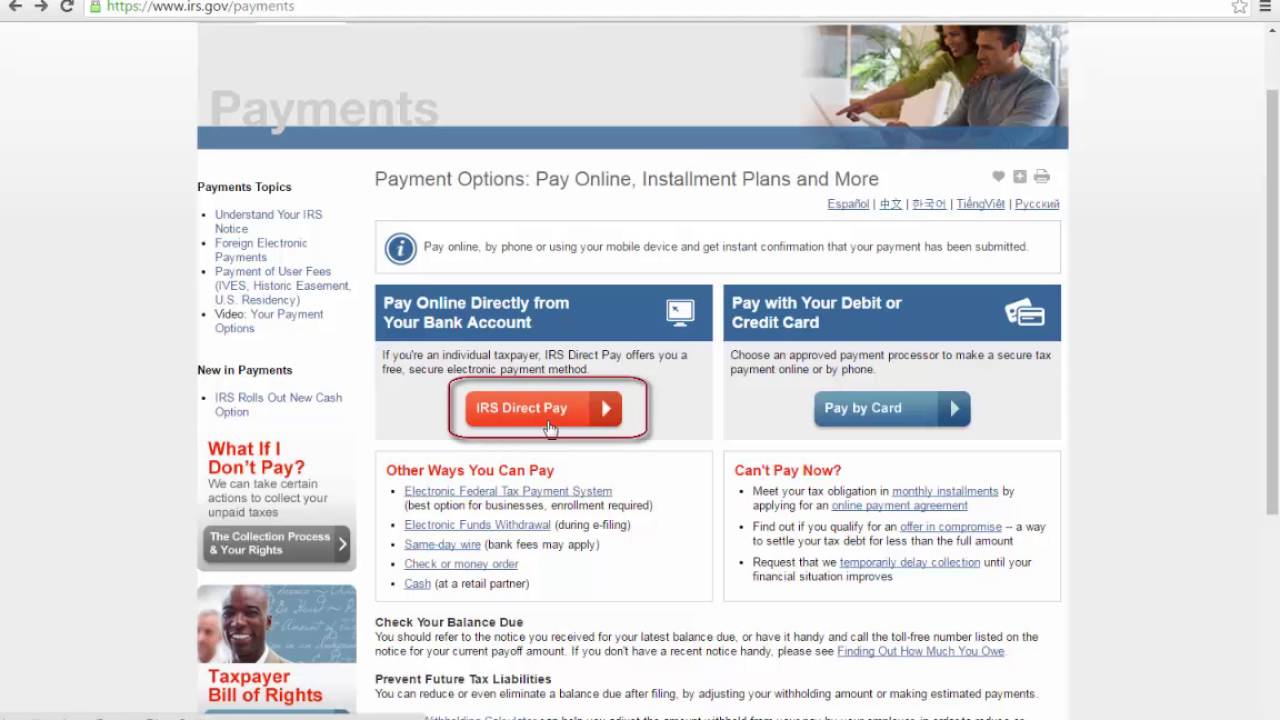

. Select the bank from the drop-down menu. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Go to Your Account Pay by Bank Account for Free Guest Payment with Direct Pay.

Payment Options Tax Portal The Tax Portal can be used to quickly and easily pay your taxes using a checking or savings account. If you are able use your checking account or credit or debit card to pay your taxes online. TurboTax online makes filing taxes easy.

Under penalties of perjury I we declare that I we have examined this return including all accompanying schedules and statements and to the best of my our belief they are true correct and complete. The online tax calculator requires some data concerning income investments and expenses of the taxpayer to calculate taxes online. We either automatically assess you or you need to file an IR3 return.

Efile your tax return directly to the IRS. Prepare federal and state income taxes online. Youll need to create an account if you dont already have one We have made arrangements with Wells Fargo to provide card services.

Please ensure that you are registered for the tax type that you wish to pay. Online transactions are preferred. TurboTax is the easy way to prepare your personal income taxes online.

Income tax for individuals Te tāke moni whiwhi mō ngā tāngata takitahi. To use the service you will need. Kindly navigate to e-File Income Tax Forms Form 64D.

Minor and irregular benefits. I cannot pay my tax debt. A registration with ROS myAccount or LPT online.

Try it for FREE and pay only when you file. Simply log in to your Individual Online Services account select Payments bills and notices from the upper left menu and then select Make a Payment from the drop-down. Next you need to choose Tax on.

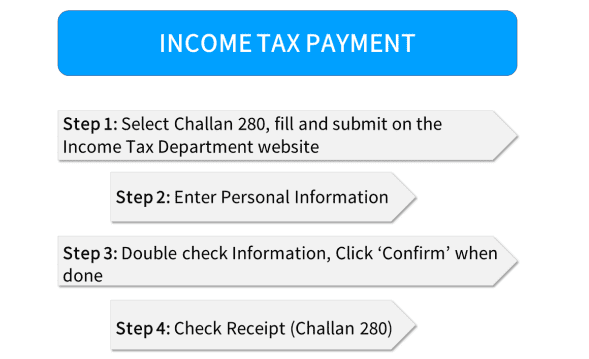

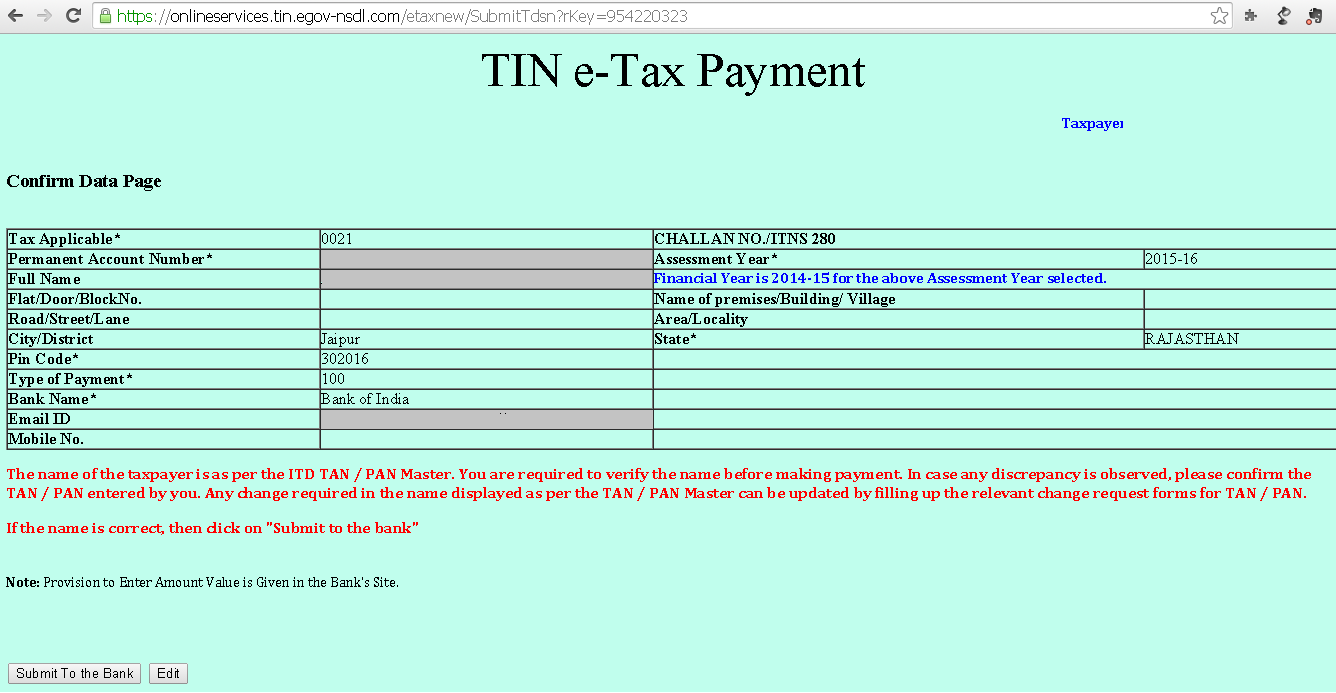

To pay your due Income Tax online at first you have to log on to the official website of the Income Tax Department and click on Challan 280. By filing your return and paying your tax through ROS you can take advantage of extended deadline dates. Choose easy and find the right product for you that meets your individual needs.

CIMB Clicksindividual only CitiDirectbusiness only HLB Onlineindividual business Maybank2uindividual only Maybank2ebusiness only MyBSNindividual only Pos Onlineindividual business Public Bank eBankindividual business. What you need to use the service. Pages in this section.

Enter the PAN No. 2021 tax preparation software. Use our tax code finder and tax on.

Choose how you want to pay using your debit cardnet banking. Log in to view the amount you owe your payment plan details payment history and any scheduled or pending payments. Generally retirees who have little income other than Social Security wont need to pay taxes on their benefits.

All ITRs are available for E-filing. Make a same day payment from your bank account for your balance payment plan estimated tax or other types of payments. You will need the Assessors Identification Number to access your payment data.

You can make payments up to and including the due date. For individuals only. Due on internet mail order or out-of-state purchases.

This is the system your employer or pension provider uses to take Income Tax and National Insurance contributions before. Carefully select the year for which you are paying taxes. Many of these retirees dont even need to file a tax return.

Make an estimated income tax payment Ready. Scripboxs Income tax calculator online helps anyone in determining their tax outflow for the financial year. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Can I Go Online To Pay My Taxes. Up until 1159 pm you can make online payments 24 hours a day 7 days a week. 100 Free Tax Filing.

Some taxpayers must pay and file their taxes online. Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates bonus or other earning items. Cigarette Stamp and Other Tobacco Product Licenses.

See Online payment of tax for further information on the taxes you can pay online. Besides ByrHASIL a host of online banking platforms can also be used to pay for income tax including. For more information please see the Tax Portal webpage or go directly to the Tax Portal to make your payment.

Go to the Tax Portal MeF for Personal Income. Online mode of submission for Form 15CA and 15CB has been enabled. Assessment year simply means the year in which the assessment of the.

E-file online with direct deposit to receive your tax refund the fastest. Withdrawal Functionality in Form 15CA has been enabled. Most people pay Income Tax through PAYE.

The quickest and easiest way is to pay online by registering for the Revenue Online Service ROS or myAccount. What happens at the end of the tax year After the end of the tax year we work out if youve paid the right amount of tax. Suspended Revoked Alcohol Licenses.

You can find more information in Mandatory electronic filing and payment. Tax codes and tax rates for individuals How tax rates and tax codes work. State Tax Lien Registry.

Mode Of Payment. When to pay Its important to make your payments by the due date to avoid penalties or interest. Foreign income and assets disclosure.

Help Videos Tutorials. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Of the person for whom tax payment is done.

Regardless of income the maximum amount one can expect their tax. Kindly navigate to e-FileIncome Tax FormsView Filed FormsForm 15CA.

How To Pay Income Tax Online Taxadda

Challan 280 Income Tax Online Payment Using Challan 280 Itns 280 Online Tax Payment

Online Tax Payment Know How To Pay Income Tax Online

Steps To Pay Due Income Tax Via Online

Income Tax Online Payment How To Pay Challan 280 Online Tax2win

How Do I Pay My Income Tax Online Youtube

Income Tax Payment How To Pay Taxes Online And Offline

Challan 280 Income Tax Online Payment Using Challan 280 Itns 280 Online Tax Payment

0 Response to "pay my income tax online"

Post a Comment